Italy’s woodworking technology production falls 8% to Euro 2.4 billion in 2024

Italy’s woodworking technology and furniture production industry recorded an 8% decline in 2024, with total production reaching Euro 2.4 billion. Export fell by 7.8% to Euro 1.7 billion, while domestic demand decreased by 9.5% to Euro 730 million. Import plummeted by 40% to Euro 180 million, strengthening the trade balance, which reached Euro 1.5 billion, down by 1.5% from 2023. The overall market consumption stood at Euro 910 million, reflecting an 18% decline. These figures position Italy among the leading European and global markets for woodworking technology, according to Acimall.

The decline in the industry reflects ongoing geopolitical and economic challenges. The uncertainties surrounding Italy’s "Industry 5.0" measures, along with the lingering effects of the COVID-19 pandemic, have slowed market recovery. The Russian invasion of Ukraine and the Israel-Palestine conflict have further impacted global trade, while labor shortages and a slow generational shift in the workforce continue to create structural difficulties.

Acimall’s director, Dario Corbetta, highlighted that the industry is experiencing a delayed impact from past government incentives, which had temporarily masked underlying weaknesses. "The situation is certainly not positive, and the industry is suffering from a temporary suspension of reality due to the COVID outburst first, and then the incentives that have delayed the structural problems of our industry for two years. The causes of this scenario are well known: labor shortage, slow generational change, and all the challenges that the mechanical manufacturing industry is facing, without forgetting the geopolitical tensions that have inevitably hindered export to a few markets," Corbetta said.

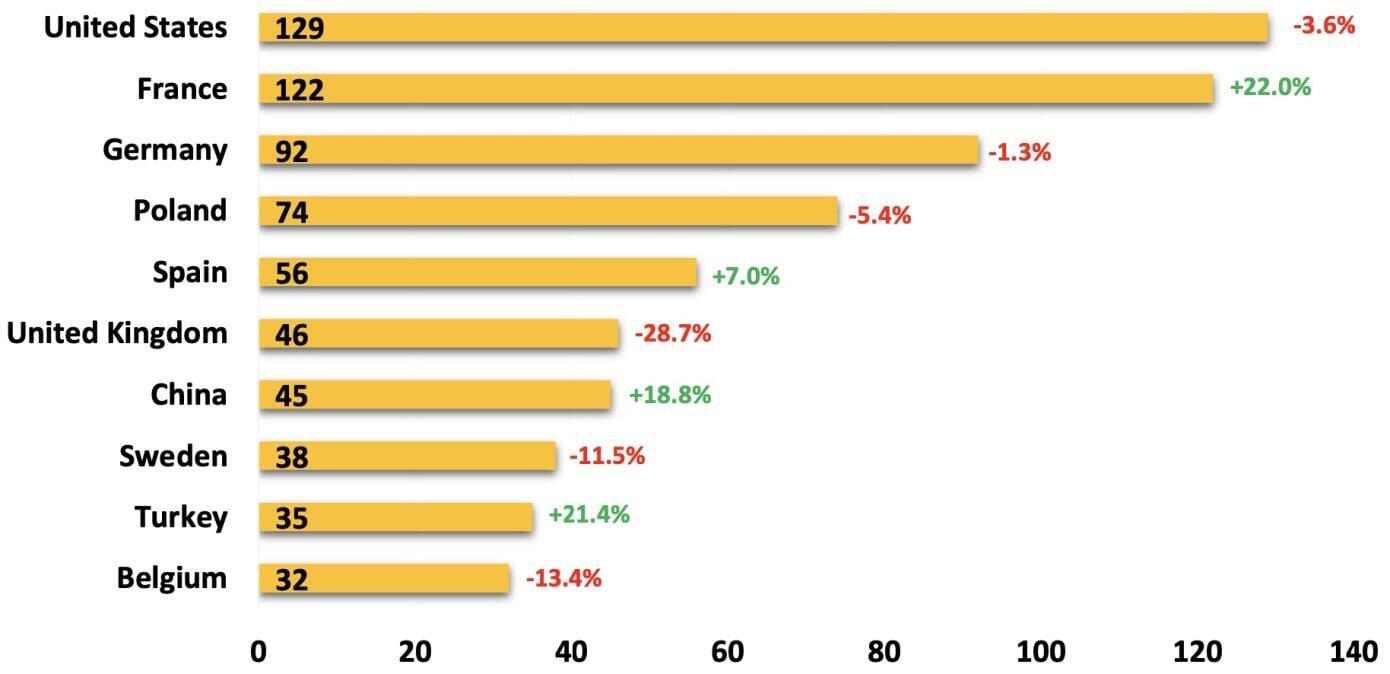

In the first nine months of 2024, Italy’s top export destination for woodworking technology was the United States, with Euro 129 million in sales, a 4% decline from the same period in 2023. France followed with Euro 122 million, up 22%, while Germany ranked third with Euro 92 million, down 1%. Other key export markets included Poland (Euro 74 million, down 5%), Spain (Euro 56 million, up 7%), and China (Euro 45 million, up 17%). The United Kingdom saw a sharp drop of 29% to Euro 46 million, while Turkey increased its purchases by 21% to Euro 35 million.

Regarding imports, Italy purchased Euro 135 million worth of woodworking machinery in the first nine months of 2024, a 32% decline. Germany remained Italy’s top supplier, despite a 49% drop, providing Euro 48 million in machinery. China followed with Euro 23 million, down 4%, while India ranked third with Euro 9 million, down 50%. Austria, Switzerland, and Spain also recorded declines, whereas Sweden (+135%), the United Kingdom (+24%), and the United States (+26%) saw increases in shipments to Italy.