Bäckebrons Sawmill: "Bright light in sight for the sawmill industry"

At the end of last year, the owner of the huge German sawmill group Ziegler Group went bankrupt. The group included just over 30 units, including two Swedish sawmills. One of them is Bäckebrons Sawmill in Värmland, which now hopes that a more active owner will take over and develop the business further.

The German wood industry group Ziegler Group became the owner of Bäckebrons Sawmill, and also Balungstrands Sawmill in Dalarna, in May 2022. Why the Germans chose to invest in these two sawmills, or Swedish sawmills in general, is something that the management of Bäckebron has no explanation for.

"Their answer was that they wanted to get at the fine Swedish forest raw material. We wondered if that meant they wanted to buy our goods, but that wasn't the case. During the good years for the sawmill industry, many people had very large coffers and Ziegler Group probably thought it would be nice to own a couple of sawmills in Sweden as well," says Stefan Gillberg, CEO of Bäckebrons Sågverk AB and Balungstrands Sågverk AB.

During the years with German ownership, the sawmills have run their operations independently and completely independently.

"We have lived our own lives, handled purchasing, sales and everything else ourselves and taken care of the finances completely independently. We've had a couple of reconciliation meetings a year with the owners, that's all," says Stefan.

So nothing really changed when Ziegler bought the sawmills?

"No, nothing. The only thing was the reporting down to Germany, which mostly cost time and effort and didn't give anything back to be honest.

Then you don't notice the bankruptcy very much now either?

"We will continue just as we have done before. We have no one to report to, but also no one to hold hands if there is a storm. But we have made sure to get a reasonably good cash flow and have tried to set ourselves up for a transition period. We have a good balance sheet and no loans, so we have a certain amount of stamina and can manage on our own for a number of months.

How important is it to find a new owner?

"Everyone needs a good shareholder and we hope that we will get someone who is more active, because we want to develop our sawmills. There is a bit of a vacuum right now and is more about management.

Increased capacity

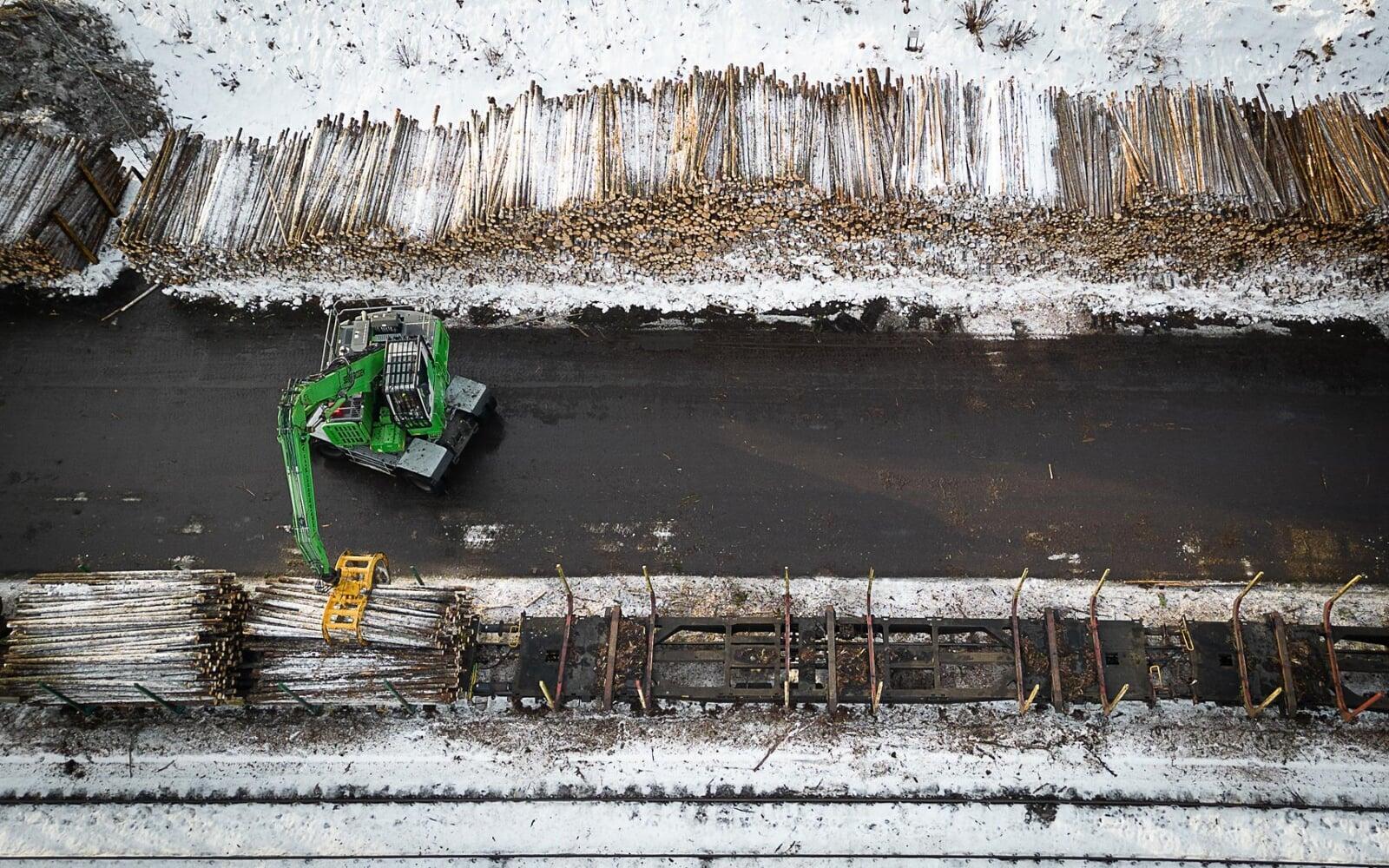

Bäckebrons Sawmill is a medium-sized sawmill in Värmland that sawed 115,000 cubic metres last year. Growth has been rapid – production has doubled in the last five years. A permit to saw 180,000 cubic meters is available.

In 2023, the entire sawmill line was replaced and the company also invested in a portable kiln, which complements existing chamber kilns, which dries up to 55,000 cubic metres per year. Three years ago, a new fully automated boiler plant of eight megawatts was also installed.

There are about forty employees in the workforce and in the production itself, the staff work two shifts five days a week.

Bäckebrons Sawmill is mainly focused on small logs of spruce (about 75 percent) and pine (about 25 percent). Logs with a top diameter from twelve to 26 centimetres are sawn and processed to standard dimensions and, more rarely, as special dimensions to order.

The raw material is purchased from an area of approximately 150 km radius, with the emphasis to the west, as Lake Fryken forms a natural barrier to the east.

The customers are mainly planing mills, Bäckebron only planes about ten percent themselves, and other wood industries such as glulam or CLT producers. Most years, just over 50 percent of the wood products are sold to customers in Sweden. The rest is exported to, for example, Norway, Germany, Austria, England, Holland, Belgium, the Baltic States and a few percent to Asia.

Red numbers

The sawmill industry is generally under severe pressure and many players have reported that high timber prices and low demand have caused profitability to decrease and in many cases disappear completely. Stefan Gillberg shares that picture.

"In the spring of 2025, there are not many sawmills that will be sawing plus. More expensive purchases of timber, higher production costs, slightly lower sales prices for both shavings and wood chips – everyone in the industry is under heavy pressure. For most people, there will be red numbers in the first quarter. We believe and hope that we will be able to be around plus minus zero," he says.

How long can it go on like this?

"It depends on how things look at the cash register. It is diligent planning that applies. Some players have other businesses, such as paper mills, with them. Then there is money and long endurance. We have had many good years in the sawmill industry and the perseverance in general among the sawmills is decent, but no one feels good about emptying the coffers. This means fewer investment opportunities and you need to use the money to survive.

Bad times thin out the sawmills and many close down or are bought up. Is it good or bad for the industry?

"I think it can be useful regardless of industry. There are many old companies that are just rolling on, that may not have developed for many years. There will come a day when they too will have to adapt to work environment laws and all that it may be. I think it is good for society as a whole that some companies are weeded out in bad times.

When does it need to have been resolved with a new owner for you?

"We have agreements with raw material suppliers for the whole of 2025 on volumes and expect to be at maximum production just like last year if prices do not get too high, but it is desirable in the spring so as not to lose too much momentum. The process is ongoing and I don't think it will be particularly difficult to find someone," says Stefan Gillberg.

Disrupted European market

Demand for sawn timber has remained fairly constant in 2024," says Anton Oskarsson, Sales Manager for Bäckebron and Balungstrand Sawmills.

"Our regular buyers have continued to buy from us. Prices have remained fairly steady during the year. What is unusual is that there is no market that is really pulling right now. For demand to rise, consumption needs to get going," he says.

A weak builders' merchants sector, high interest rates after the pandemic and bankruptcies that made people unemployed created the restraint in the market that still remains, says CEO Stefan Gillberg, who says that the recession is also noticeable in the sawmills' export business.

"Germany, which has always been Europe's main locomotive, is having a difficult period. France as well. Who could have said a few years ago that Italy and Holland would be countries that pull hard in Europe? People would have laughed," he says.

"The price picture for the average person would probably have been lower if the war in Ukraine had not been going on. Russia is a major player that affects our business at both ends. Still, it feels like there is some increase in demand and a positive trend in the market. The industry is having a tough time, but we hope and believe in a brightening up," says Stefan Gillberg.